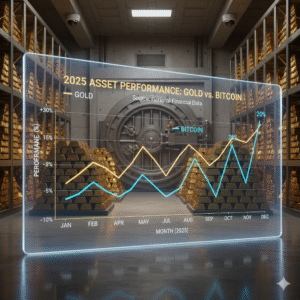

Why Gold Outperformed Bitcoin in 2025

One of the major surprises of 2025 was how well gold outperformed Bitcoin in the continuing gold vs. bitcoin 2026 discussion. According to various market reports and trader chats online, gold rose as central banks actively accumulated reserves, especially in Asia and the Middle East. In contrast, even though ETFs were widely adopted earlier in the year, Bitcoin was unable to maintain its safe-haven story.

The dominance of gold in 2025 can be explained by three main factors:

1. Central banks made a significant shift in favor of physical reserves

Gold prices reached all-time highs as a result of increased buying by nations including Saudi Arabia, China, India, and Turkey. As a result, there was a squeeze on supply, which allowed gold to maintain consistent increases despite worldwide instability.

2. Bitcoin’s “Risk Asset” Label Returned

Bitcoin ETF inflows decreased substantially by late 2025. According to crypto specialists like @CryptoPatel and @TheCryptoDog, traders increasingly used Bitcoin for speculation rather than long-term hedging. Sharp selloffs during times of macro stress were caused by this.

3. Tangible Assets Benefited from Geopolitical Shock Events

Global investors were drawn to gold, the asset with the longest track record of stability, due to rising tensions in Eastern Europe and currency pressures in emerging nations.

However, the situation is shifting as we go toward gold vs. bitcoin in 2026. The next halving of Bitcoin and regulatory clarification could tip the scales once more.

Gold in 2026: Central Banks, Interest Rates & Price Forecasts

Three macro factors will influence the gold market in 2026: central bank purchases, interest rate reductions, and record-breaking demand.

1. It is anticipated that central banks would continue to accumulate

Recent data suggests another year of high gold demand driven by global reserve managers. Many countries are moving away from the US dollar and toward “neutral assets.” This tendency is projected to continue, placing structural upward pressure on pricing.

2. Rate Reductions Increase the Allure of Gold

Most major economies, including the United States and Europe, are expected to start a cycle of rate cuts by mid-2026. Lower rates reduce the opportunity cost of storing gold (which earns no interest), making it more tempting to institutional investors.

3. 2026 Price Projections

Forecasts from analysts:

Bullish scenario: $2,850–$3,100 per ounce

Baseline: $2,600–$2,750 per ounce

Bearish decline: $2,350–$2,400 per ounce

Overall, gold maintains gathering momentum as a core safe haven in any gold vs bitcoin 2026 analysis.

Bitcoin in 2026: ETF Flows, Halving Effects & Regulation Outlook

The story of Bitcoin is uneven but getting better as 2026 approaches.

1. ETF Flows Expected to Rebound

After a weak second half of 2025, Bitcoin ETF flows are predicted to rise again due to:

Rate reductions boost liquidity

Increased institutional interest

Integration with global wealth platforms

In the gold vs. bitcoin battle in 2026, Bitcoin might reclaim some of its lead if ETF inflows pick up speed.

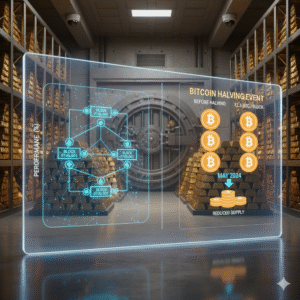

2. The Halving Supply Shock Is Still Occurring

Block rewards were drastically cut in 2024, but the price impact usually manifests itself 12 to 18 months later. This coincides with the middle of 2026, which might lead to a fresh shortage of Bitcoin.

3. The Future of Regulation Is Now Clearer

The U.S., UK, and Singapore enacted clearer tax and custody legislation for crypto in late 2025. This provided institutions more confidence to adopt Bitcoin as part of long-term diversified portfolios.

Price estimates for 2026:

Bullish scenario: between $120,000 and $150,000

Baseline: $85,000–$110,000

Downside: $55,000–$65,000 (assuming ETF flows stay sluggish)

Bitcoin’s potential for asymmetric gain remains strong—but so does the volatility that drives gold vs bitcoin 2026 decisions.

Head-to-Head Comparison (Volatility, Liquidity, Taxes, Storage)

| Factor | Gold | Bitcoin |

|---|---|---|

| Volatility | Low | High |

| Liquidity | High (spot + futures) | Very high (24/7 global markets) |

| Taxes | Capital gains | Varies by country + crypto tax classification |

| Storage | Physical vaults/ETFs | Wallets, custodians, cold storage |

| Institutional Adoption | High | Rapidly increasing |

| Risk Profile | Stable, long-term store of value | High-risk/high-reward |

Country-by-Country Breakdown (USA, UK, India, Europe, Singapore, UAE)

The United States

Gold demand projected to surge owing to recession concerns

Bitcoin acceptance is growing through ETFs and retirement funds.

Both assets benefit from strong regulatory certainty.

United Kingdom

Gold favored for inflation hedging

Crypto taxes are still stringent yet doable.

India

One of the biggest gold marketplaces in the world

Younger investors are increasingly adopting cryptocurrency, but regulatory ambiguity still exists.

Europe (EU)

Currency weakness encourages the purchase of gold.

MiCA laws facilitate the legal ownership of Bitcoin.

Singapore

Crypto-friendly regulation

Strong gold vaulting infrastructure

Both are frequently held by investors in balanced portfolios.

UAE

Growing retail demand and imports of gold

Dubai is becoming into a major worldwide cryptocurrency hub.

Rich people have a strong interest in Bitcoin

Investors in these areas view gold vs. bitcoin 2026 more as a dual-asset hedging strategy than as a rivalry.

Final Verdict + Risks to Watch

In 2026, both gold and Bitcoin will be important components of global portfolios, but for different reasons.

The Stronger Safe Haven Is Still Gold

Supported by central banks

Stable historically

Reduced exposure to technical and regulatory threats

Ideal hedge against currency devaluation

Bitcoin Offers Greater Potential Gains

Halving supply effects

Growing institutional flows

Increasing the clarity of regulations

Perfect for investors looking for asymmetric profits

Biggest Risks to Watch in 2026

Gold: Central bank buying slows down, stronger USD

Bitcoin: Strict regulations, withdrawals from ETFs, hacks, and shocks to liquidity

Verdict: For pure stability, gold wins the safe-haven argument in the gold versus bitcoin 2026 analysis.

However, Bitcoin still provides considerably more potential for long-term growth.

The most resilient method incorporates both each offsetting the shortcomings of the other.

execellent